A Simple Explanation of Stock Ownership

Think of a stock as your ticket to owning a part of a company. It's like having a small piece of a big business puzzle.

Hey there, financial explorers!

Let's get into the details about Tata Technologies Limited, and what they're bringing to the table with their Initial Public Offering (IPO).

Founded in 1989, Tata Technologies is quite a unique company in India and even across the globe. They specialize in helping car companies right from the initial sketches of a car to getting it ready for the market. Based in Pune, this company isn't just focusing on cars these days; they're also exploring aerospace projects. Still, a significant part of their core business comes from collaborations with big names like Tata Motors and Jaguar Land Rover.

Tata Motors is about to hit a jackpot with their big Rs 3,000-crore IPO where they're selling a bunch of their shares in Tata Technologies. From November 22 to 24, they, along with a couple of big investor buddies, are offering these shares to folks like you and me. If they sell them at the top price they're asking for, between Rs 475-500 each, they could make back 68 times what they originally put in! That's like turning one rupee into 68 overnight.

Issue opens: Nov 22, 2023

Issue closes: Nov 24, 2023

Offer For Sale: 60,850,278 Shares

Total Issue Size: Rs 3,042 Crore

Price Band: Rs.475–500 per share

Face Value: Rs.2 per share.

Lot size: 30 shares and multiples

Listing On: BSE and NSE

Tata Motors recently sold nearly 10% of their stake in Tata Technologies to TPG Rise Climate and the Ratan Tata Foundation for Rs 401.8 per share. They said it was a fair deal where both sides were happy. But here's the twist: when Tata Technologies opens up their shares to the public in the IPO, regular investors like you and me will have to pay 25% more than that price for each share.

Even with the price hike in the IPO, Tata Technologies is still like the bargain deal in the stock market. Their price compared to their earnings is way lower than other tech companies. Think of it like getting a good quality product at a lower price. While other companies like KPIT Technologies, Tata Elxsi, and L&T Technology Services are priced higher based on their earnings.

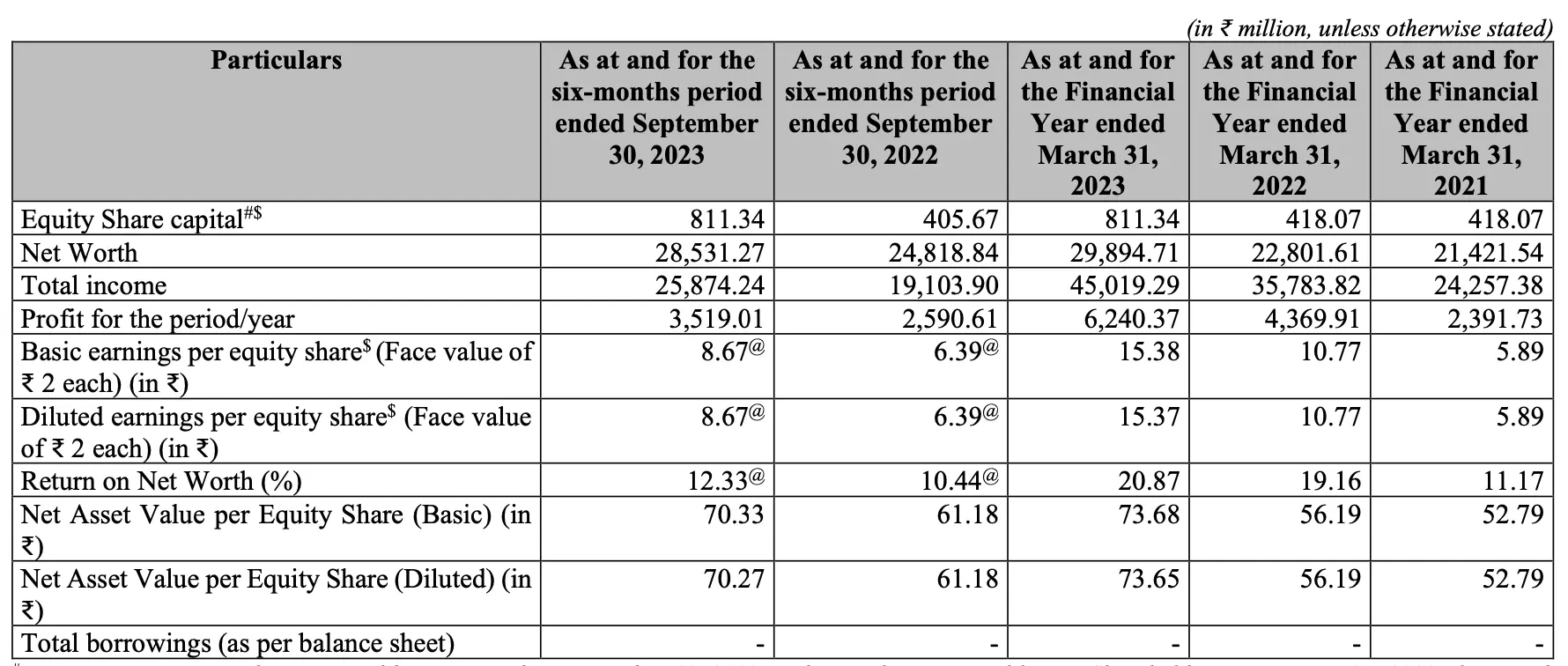

As for the financials, they reflect a company on the rise. With an impressive profit of Rs. 3,519.01 million for the half-year ending in September 2023, and a solid net worth. In summary, Tata Technologies IPO is not just an investment opportunity; it's an invitation to be part of a legacy of innovation and excellence. So, if you're looking to add some tech flair to your portfolio, keep your eyes peeled on this one.

Remember, all investments come with their risks, so due diligence is key. Buckle up and get ready for an exciting ride with Tata Technologies! 🚗💼📈

Think of a stock as your ticket to owning a part of a company. It's like having a small piece of a big business puzzle.

A Demat account, short for 'dematerialized account', is like a digital locker where you keep your stocks, bonds, and other securities.

An IPO is like the company opening its doors to the world for the first time. They start selling shares to the public, which means anyone can buy a piece of the company.