November 17, 2023

Why Your Savings Account Isn't Beating Inflation

Hey there, smart savers!

Today, let's chat about something we often overlook: the real value of money sitting in our savings accounts.

You know how we all love the safety net of a savings account? It's comforting, right? But here's the catch: most savings accounts offer interest rates around 3% to 4%, with only a few going a bit higher. Seems decent at first glance.

However, let's talk about inflation – the invisible force that gradually makes everything more expensive. Picture yourself at the veggie market. This year, your Rs.100 fills a basket with tomatoes, onions, and potatoes. But next year, due to inflation, that same Rs.100 might only get you half a basket of those very same veggies.

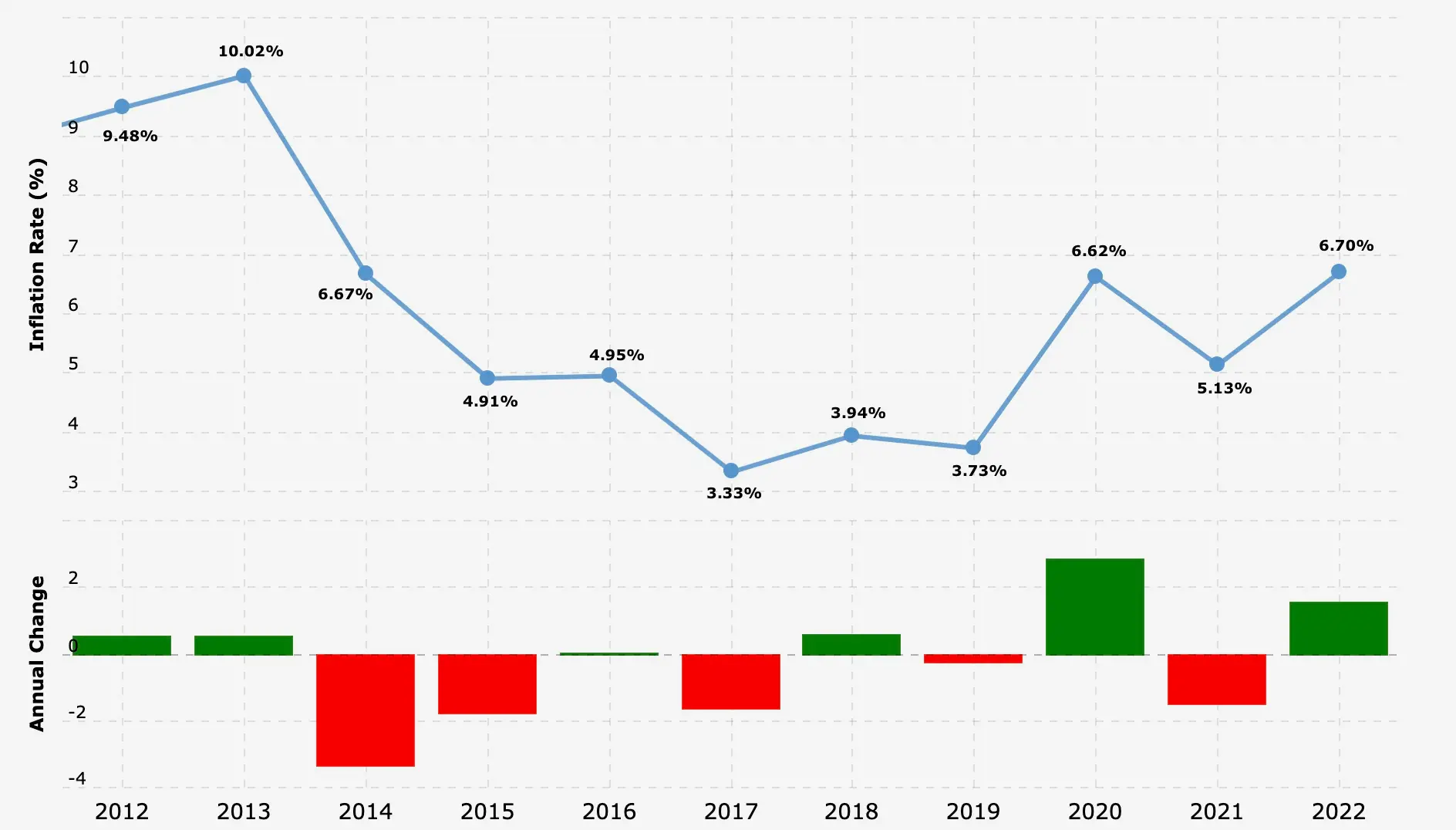

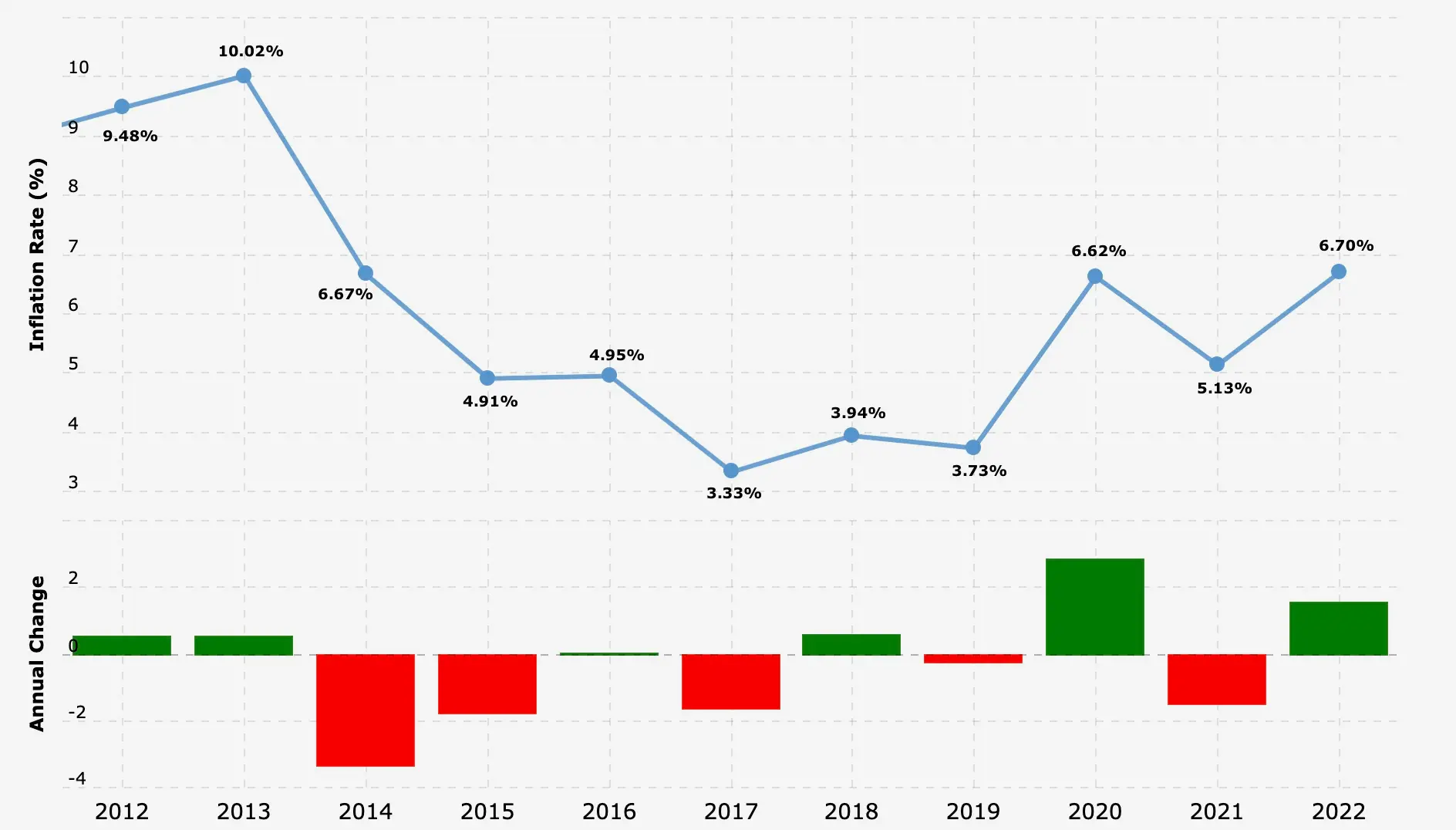

Over the last decade, from 2012 to 2022, the average inflation rate, based on the consumer price index, hovered around 5.95%. Even including this year up to October 2023, we're looking at 5.93%. Think of the Consumer Price Index, or CPI, as a big shopping list that keeps an eye on the prices of things people commonly buy, like food, clothes, and a bunch of other everyday items, totaling up to 260 different types of goods and services. Now, when we talk about retail inflation based on the CPI, it's like tracking how the price tag on that shopping list changes over time.

Source: macrotrends.net

Now, imagine your money is a little soldier fighting in the battle of economics. If it's growing at 3% in a savings account but inflation is charging at 5.93%, who's winning? Yep, inflation. Your money's buying power is actually shrinking!

So, what's the solution? Seek out investments that offer returns higher than the rate of inflation. Stocks, mutual funds, bonds—there are several options available. However, remember that higher returns often come with higher risks. It's all about finding the right balance that suits your needs.

In short, while savings accounts are great for immediate safety, they're not the best at preserving the long-term value of your hard-earned cash. It’s like putting your money on a slow treadmill while inflation is sprinting on the next one. Time to explore and diversify to stay ahead in this financial race!

Until next time, keep saving smartly and investing wisely! 🌟💰📈