March 12, 2024

Piotroski Score Explained: Decoding Financial Strength

Hello, Financial Explorers!

Today, let's delve into a concept that might sound complex but is incredibly insightful for stock investors – the Piotroski Score. Developed by accounting professor Joseph Piotroski, this score is a valuable tool for evaluating the financial health of a company. Let’s break it down and understand how it works, along with an example to make it more relatable.

What is the Piotroski Score?

The Piotroski Score is a financial scoring system used to assess the strength of a company's financial position. It uses nine criteria based on accounting principles to score a company, with each criterion earning a point if met. The total score ranges from 0 (weakest) to 9 (strongest).

The Nine Criteria

The score is based on three aspects of a company's financial statements: profitability, leverage/liquidity, and operating efficiency.

Profitability

- Positive Net Income: Profit in the current year.

- Positive Return on Assets (ROA): Indicates effective management.

- Improvement in Operating Cash Flow: More cash flow than net income is good.

- Quality of Earnings: Operating cash flow exceeds net income.

Leverage/Liquidity

- Decrease in Long-Term Debt: Lower debt compared to assets is better.

- Increase in Current Ratio: Ability to pay short-term obligations.

- No New Shares: Not diluting shareholder value.

Operating Efficiency

- Higher Gross Margin: Indicates improved efficiency.

- Higher Asset Turnover Ratio: Company is generating more revenue per rupee of assets.

Why Does It Matter?

- Identifying Strong Stocks: High scores indicate strong financial health.

- Spotting Value Stocks: Often used to find undervalued stocks with improvement potential.

- Risk Assessment: Low scores can indicate potential financial trouble.

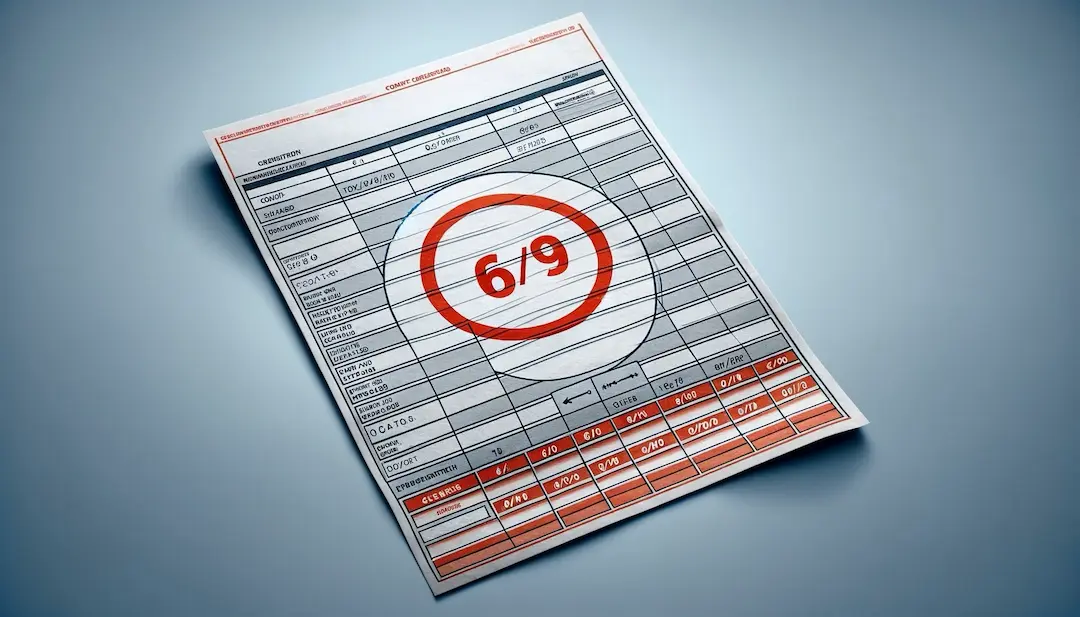

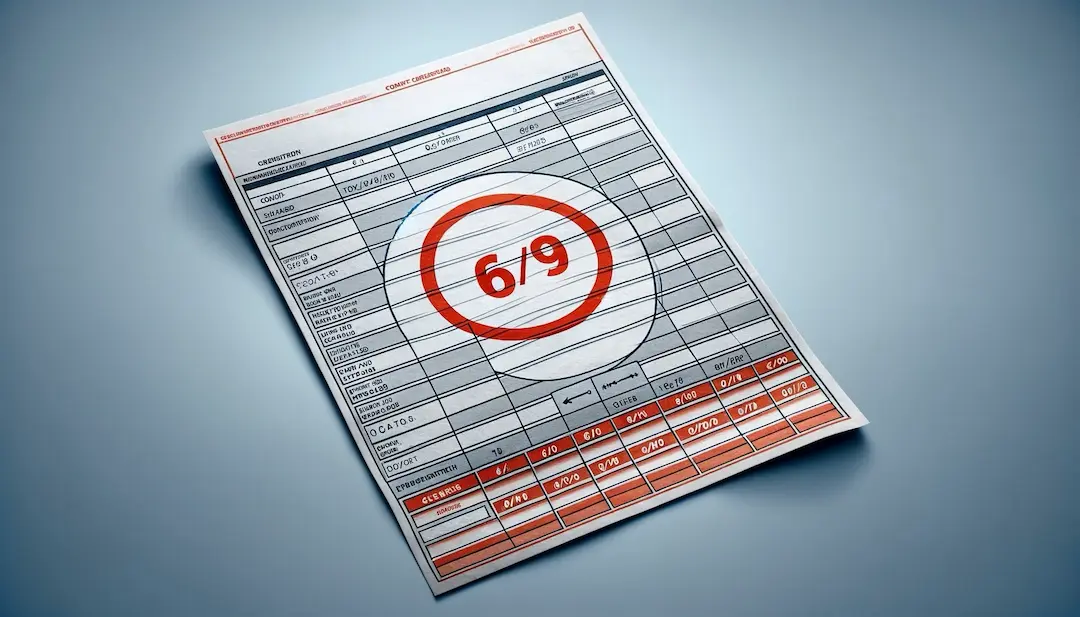

Example: Company XYZ

Let’s apply the Piotroski Score to a hypothetical Company XYZ:

- Positive net income? Yes (1 point)

- Positive ROA? Yes (1 point)

- Operating cash flow improvement? Yes (1 point)

- Cash flow exceeds net income? No (0 points)

- Decreased debt? Yes (1 point)

- Increased current ratio? No (0 points)

- No new shares? Yes (1 point)

- Higher gross margin? Yes (1 point)

- Higher asset turnover? No (0 points)

Total Piotroski Score: 6/9

This score suggests Company XYZ is in reasonably good financial health, but there's room for improvement, particularly in cash flow quality, current ratio, and asset turnover.

The Piotroski Score is a handy tool for investors looking to delve deeper into a company's financials beyond surface-level analysis. It provides a quick, quantifiable way to assess a company’s financial strength, helping make more informed investment decisions.

Remember, while useful, the Piotroski Score is just one tool in an investor’s toolkit. It should be used in conjunction with other analyses and not as the sole basis for investment decisions.