Adding Motilal Oswal Nasdaq 100 FOF to My Live Portfolio

Join us live as we add Motilal Oswal Nasdaq 100 FOF to our portfolio this Monday, April 15, 2024. Discover insights and real-time updates on our investment journey!

Greetings, Market Mavericks!

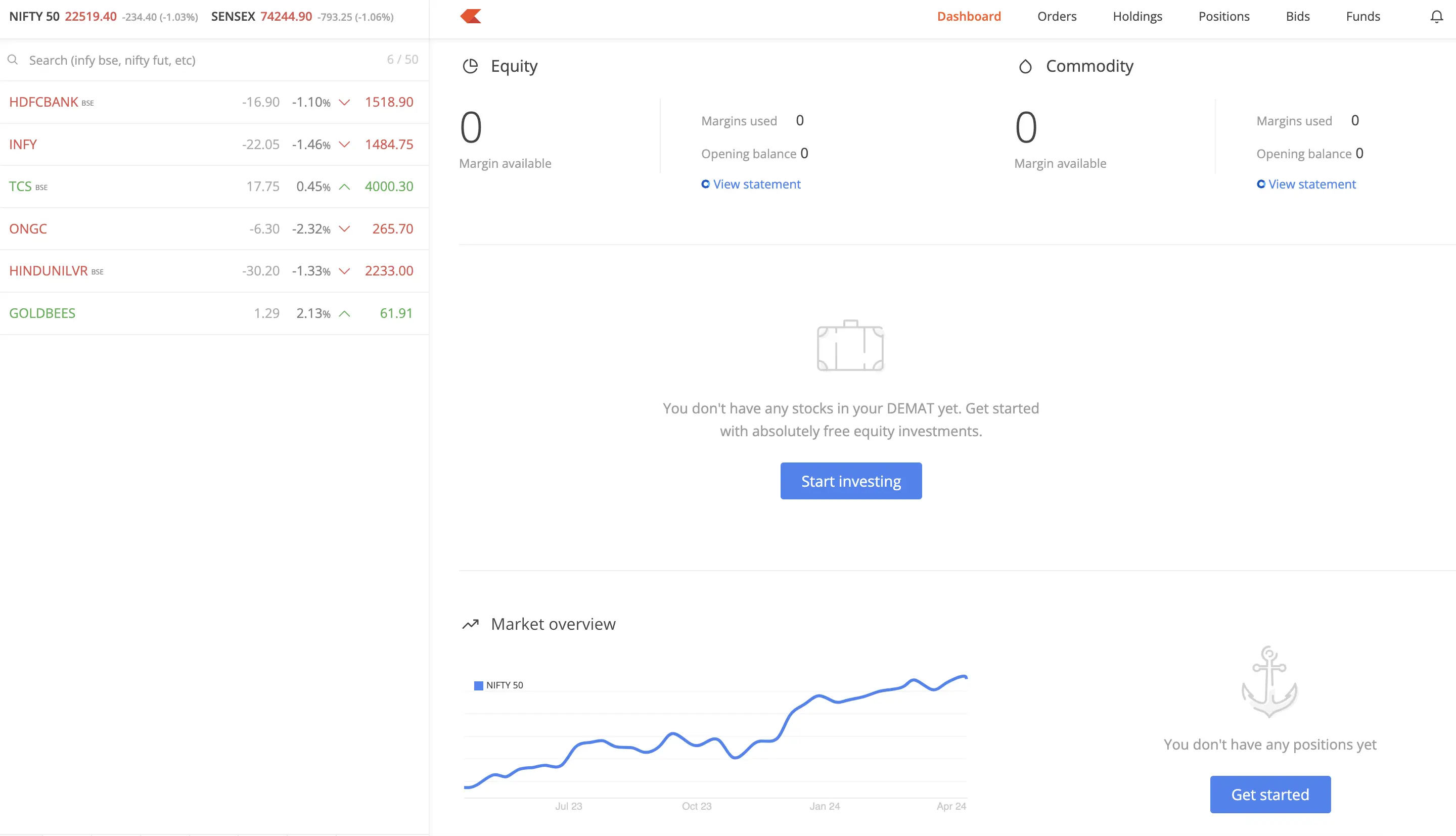

Today marks a thrilling milestone in our journey together as I kick off our live trading portfolio. Starting from scratch with a budget of Rs.0, we're stepping into the dynamic world of real-time investing. Our aim? To build a robust and diversified portfolio right before your eyes. I've initiated purchases live as the market opened, and below I provide transparent, step-by-step updates with screenshots of each transaction. Join me as we navigate the exciting ups and downs of the stock market together, learning and growing with every trade.

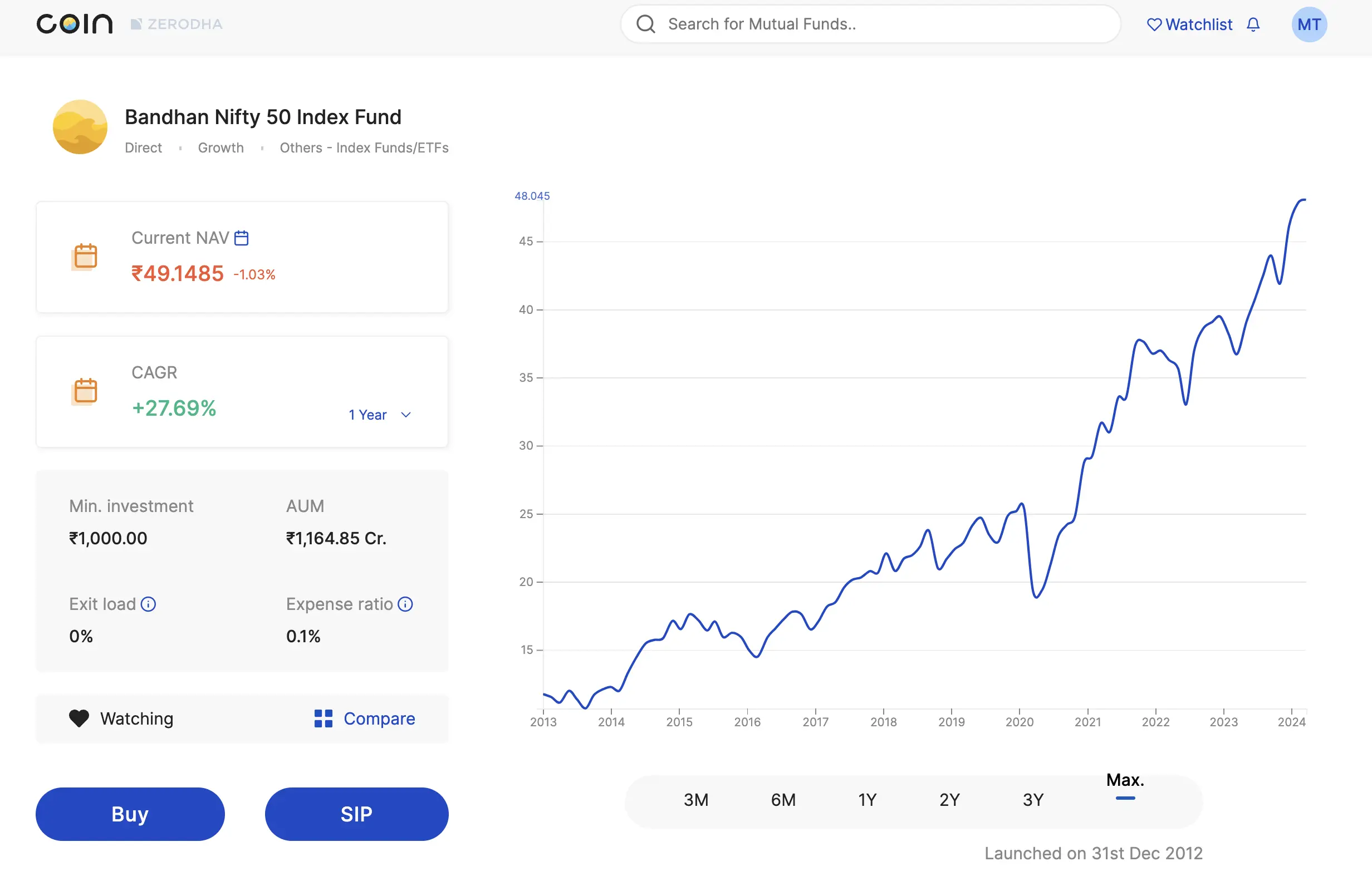

As detailed in my previous two blog posts, I have now invested in the Bandhan Nifty 50 Index Fund. Specifically, I have executed two transactions of Rs. 10,000 each into the Bandhan Nifty 50 Index Fund. The current Net Asset Value (NAV) of the Bandhan Nifty 50 Index Fund stands at ₹49.1485.

Log in to Kite, the Zerodha trading platform, and as you can see, I've opened a new trading account where the balances are currently at zero.

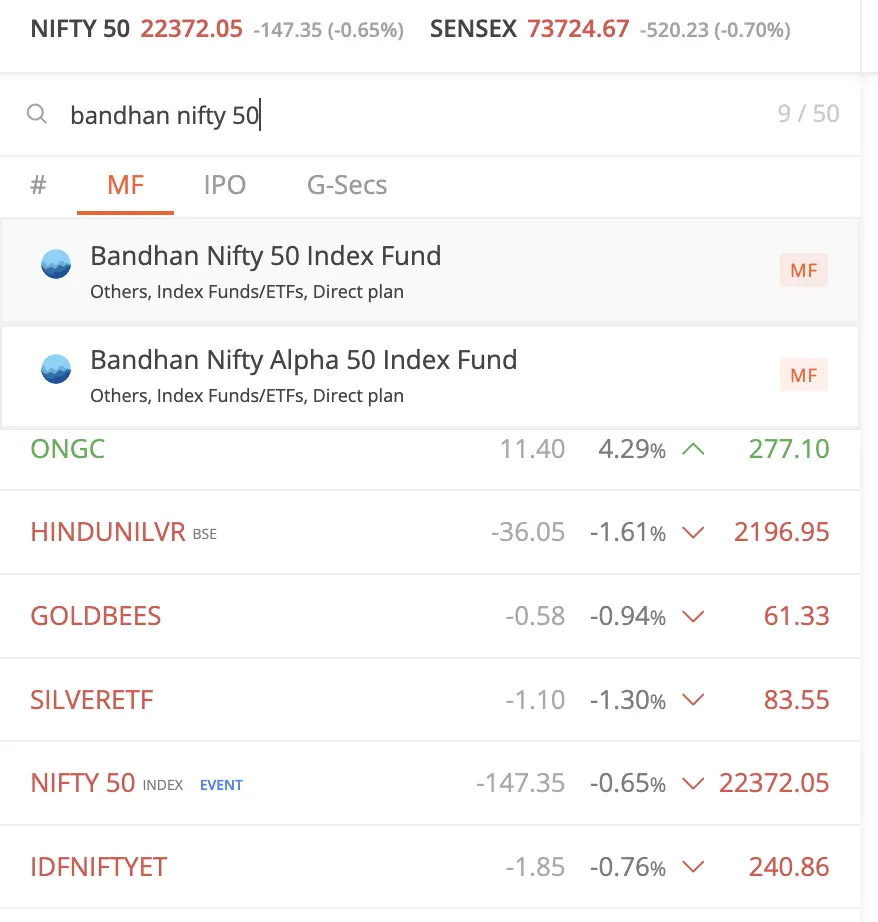

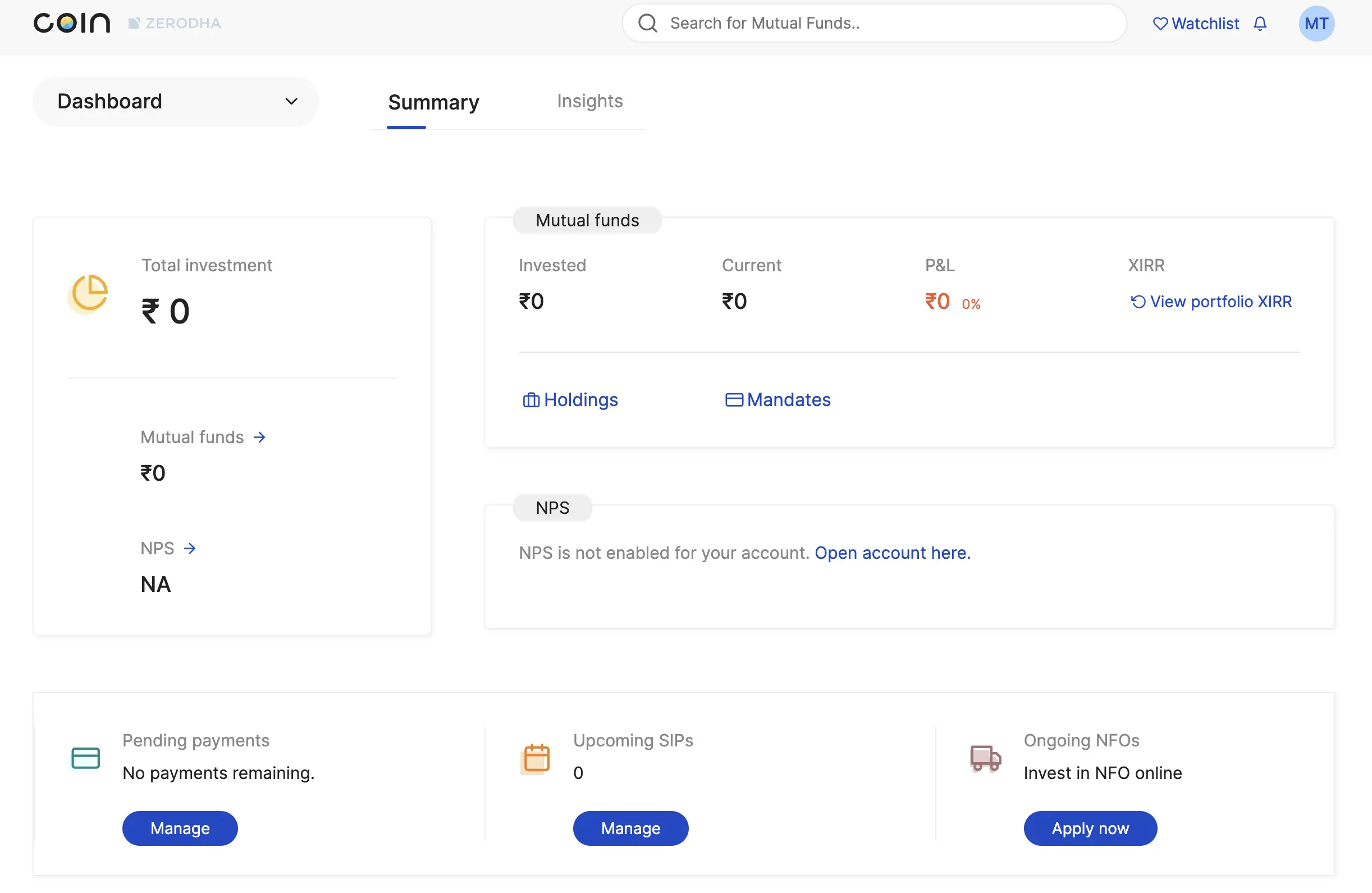

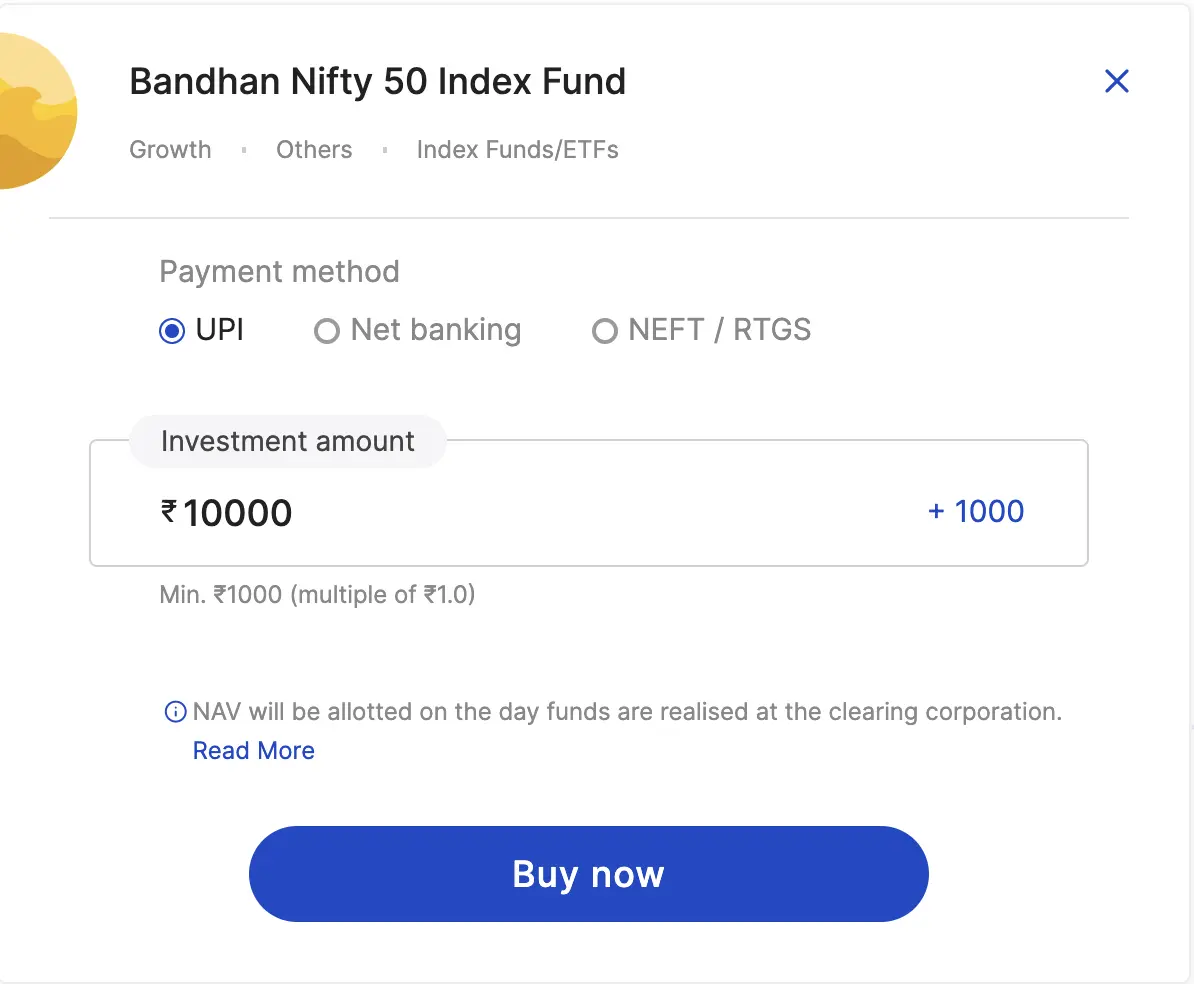

Navigate to the "MF" section below the search bar and search for "Bandhan Nifty 50." This will redirect you to "Coin by Zerodha," where the mutual fund purchases will be completed.

Search for the Bandhan Nifty 50 Index Fund using the search bar and verify the expense ratio before making a purchase. The expense ratio of the Bandhan Nifty 50 Index Fund is 0.1%.

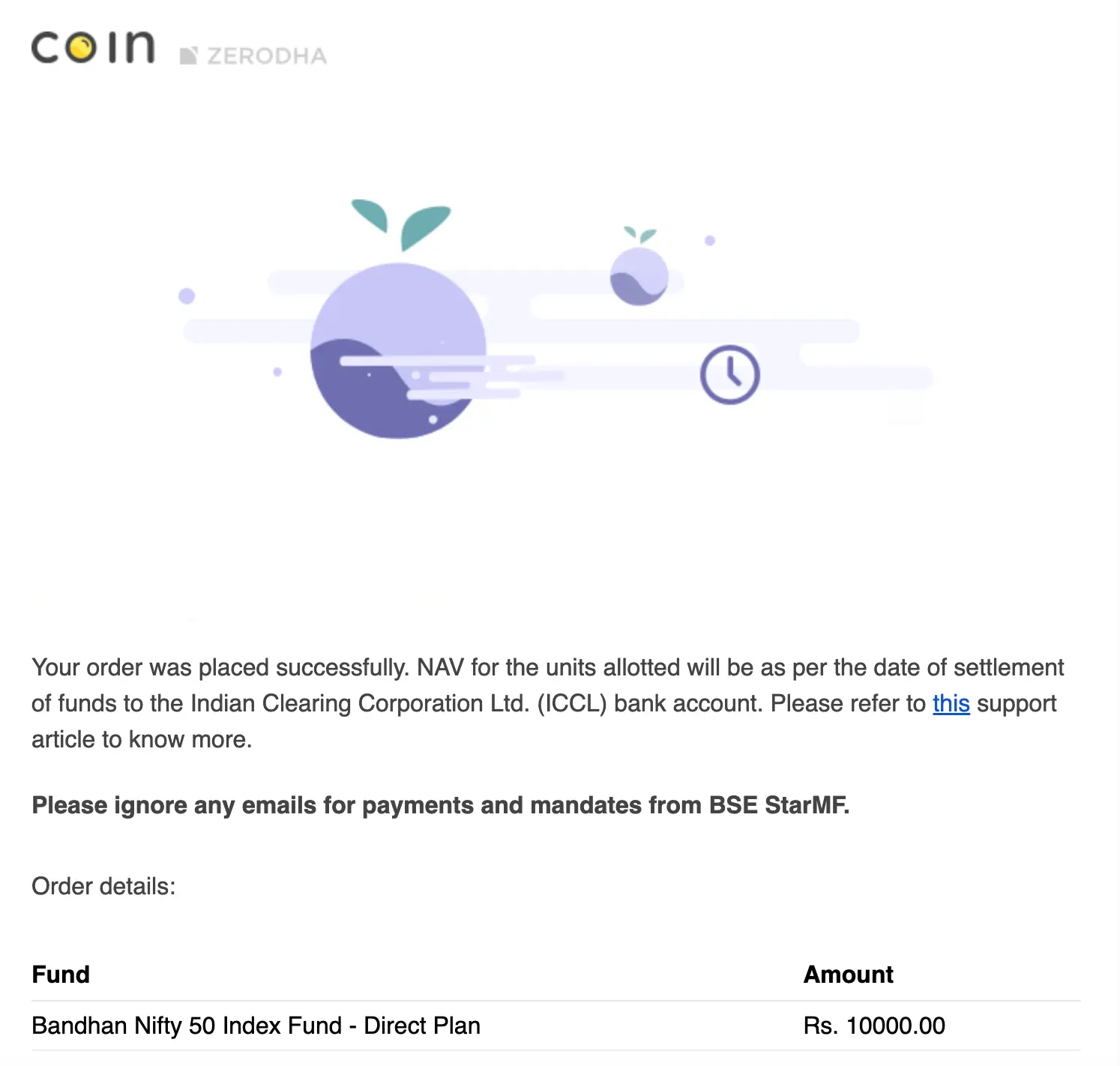

Click "BUY" and enter the amount you wish to invest. Today, I've made two separate transactions of Rs. 10,000 each. Unlike stocks, mutual fund purchases do not show immediately on the orders page; they take some time to process. Once funds are settled, the purchase will occur after the cutoff time.

Once payments are made, you'll receive an email notification stating "Order was placed successfully."

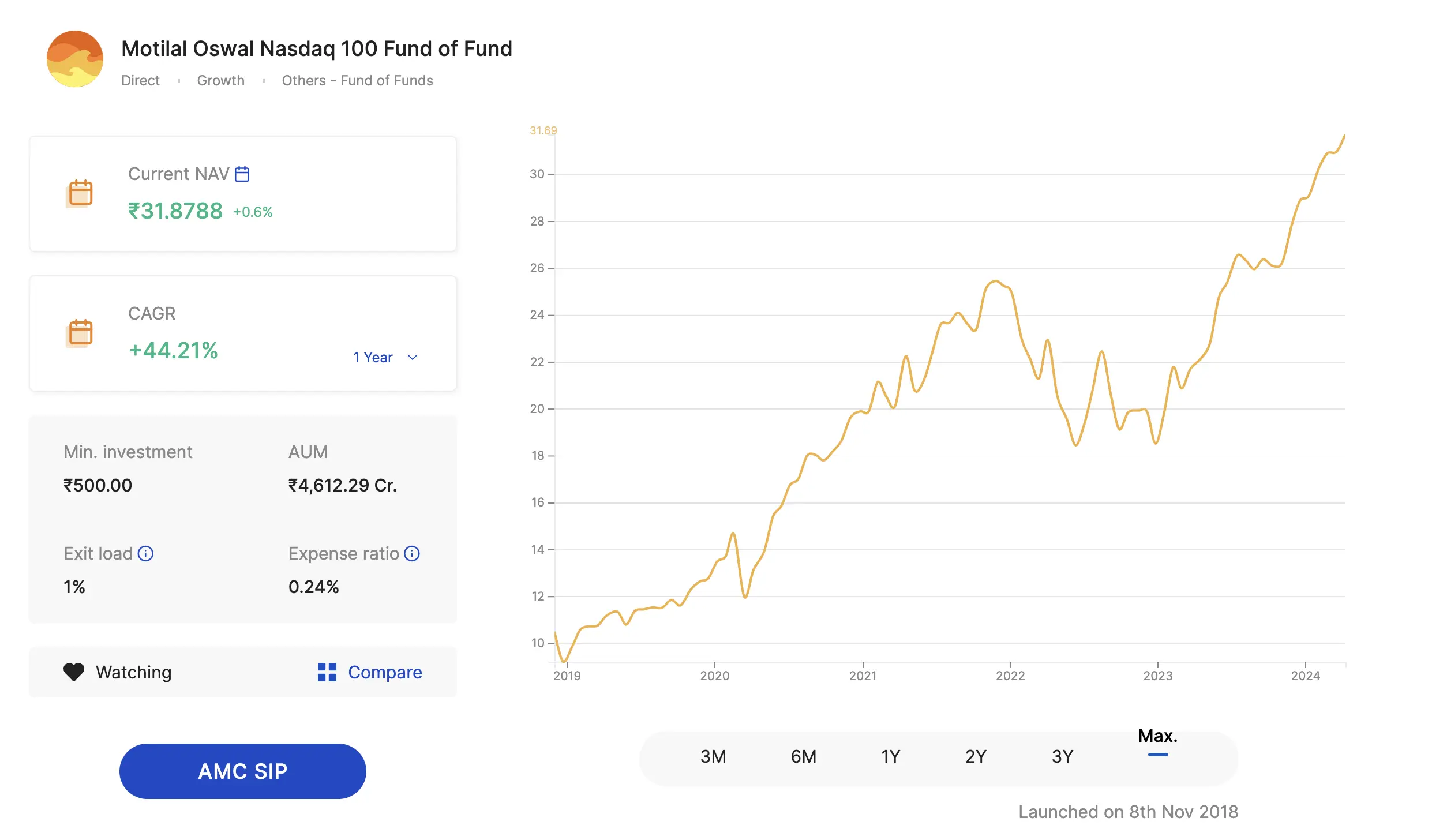

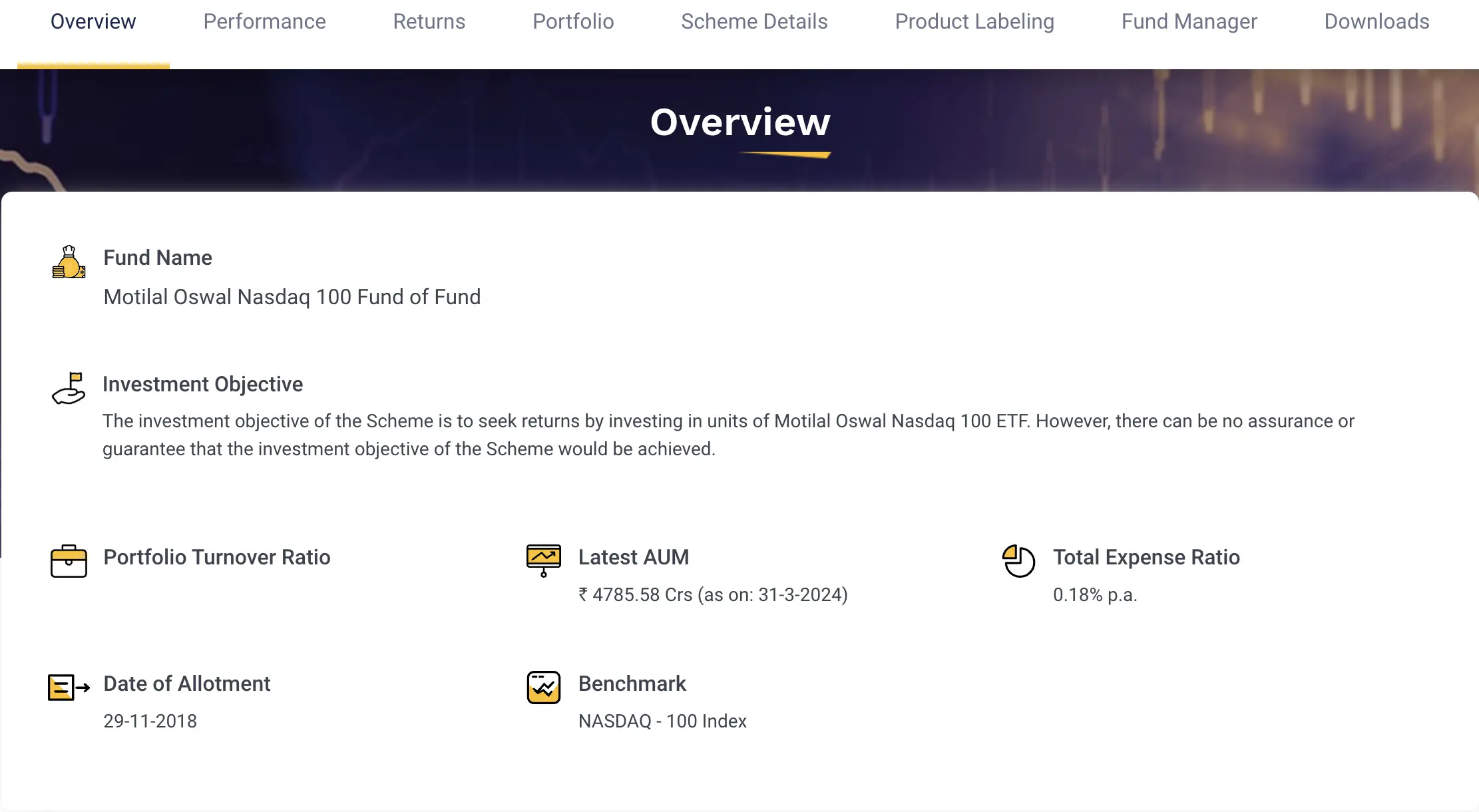

You might be wondering why I'm not purchasing the Motilal Oswal Nasdaq 100 FOF and instead have decided to buy the ICICI Prudential NASDAQ 100 Index Fund. Firstly, there is no lump sum investment option available for the former; it only allows for SIPs. Additionally, the expense ratio shown on Zerodha is 0.24%, whereas on the Motilal Oswal website, it's listed as 0.18%. I'm unsure why there's this discrepancy. Due to these confusions, I opted for the ICICI Prudential NASDAQ 100 Index Fund.

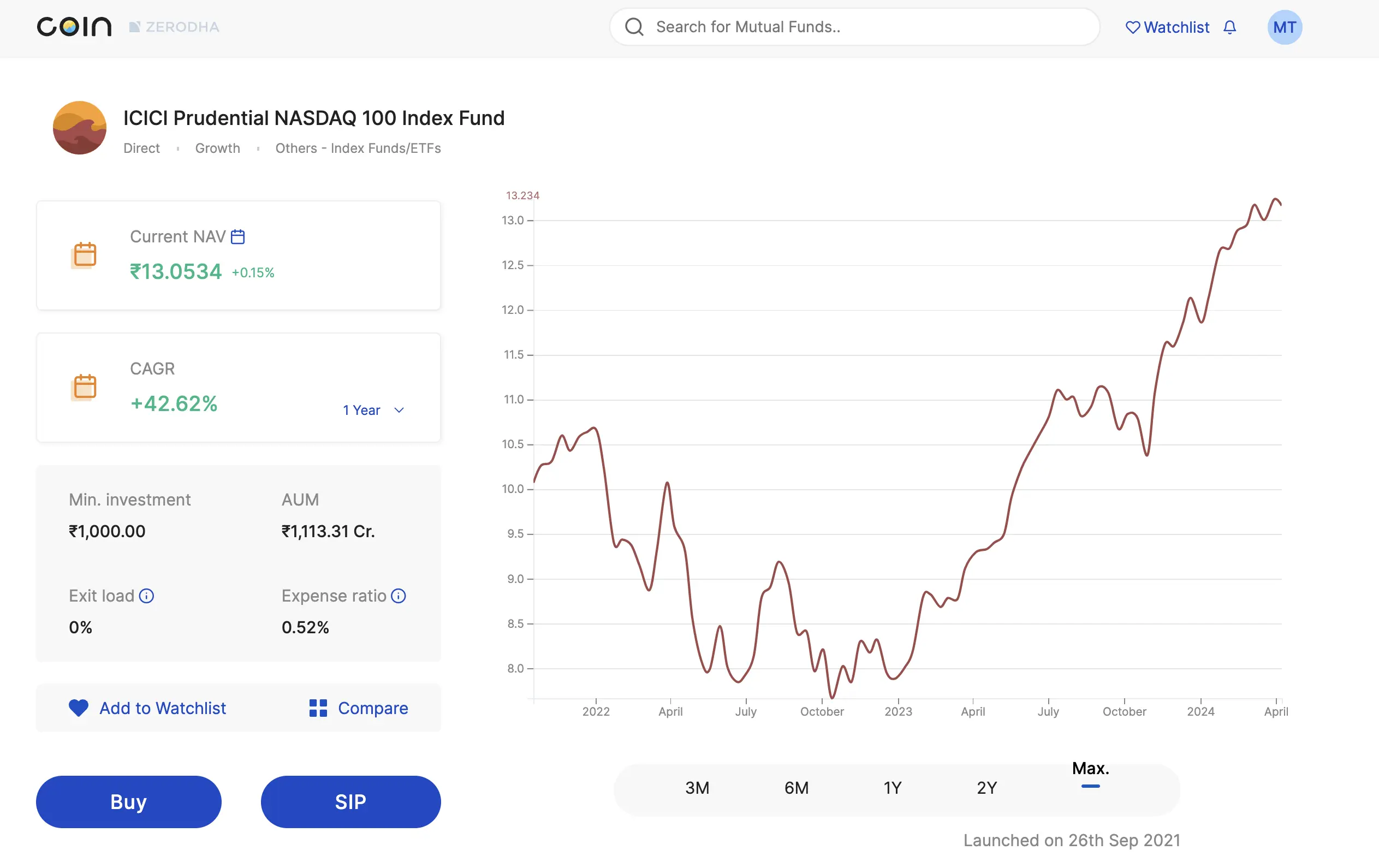

Search for the ICICI Prudential NASDAQ 100 Index Fund using the search bar and verify the expense ratio before making a purchase. The expense ratio of the ICICI Prudential NASDAQ 100 Index Fund is 0.52%

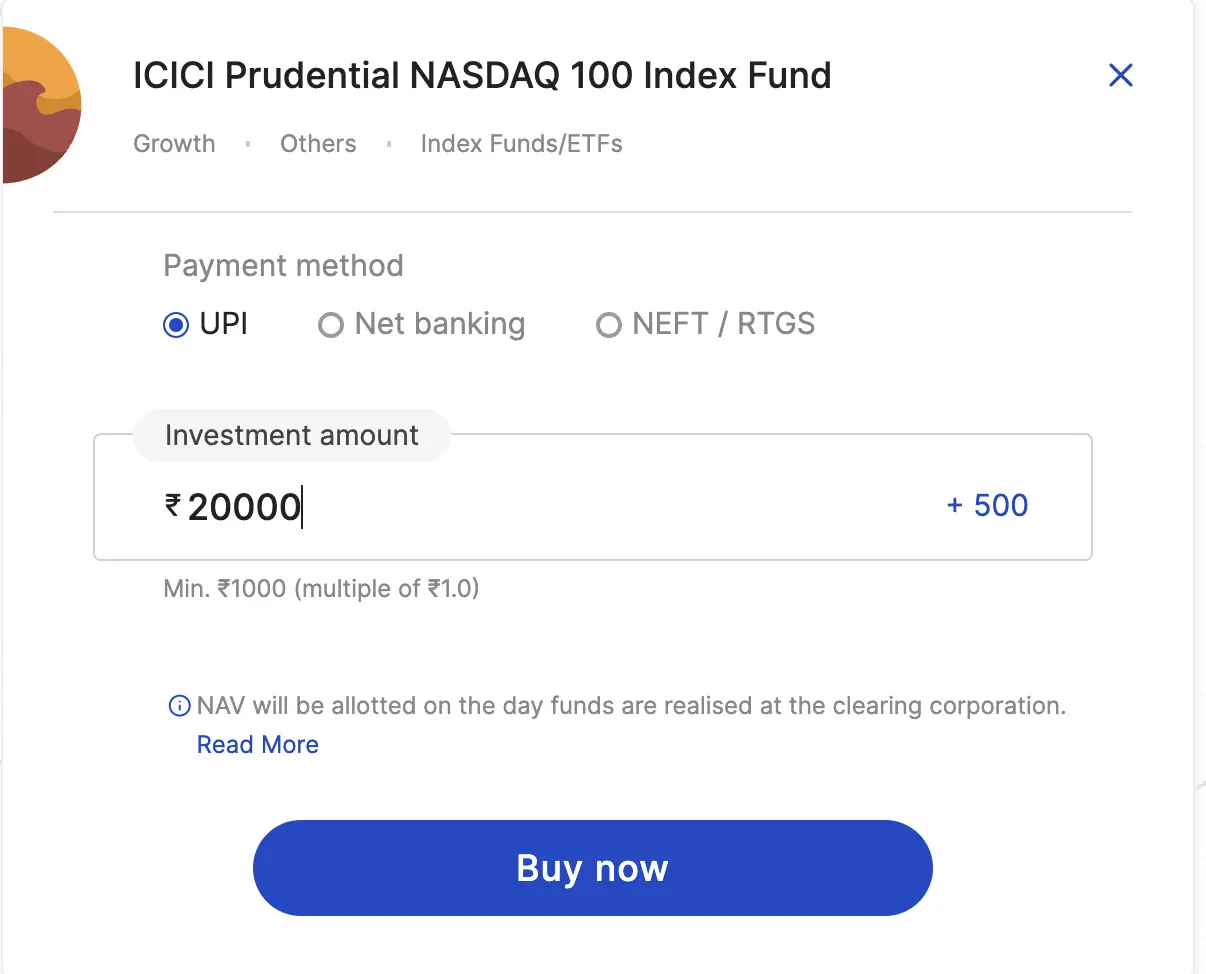

Click "BUY" and enter the amount you wish to invest. Today, I've made one transaction of Rs. 20,000.

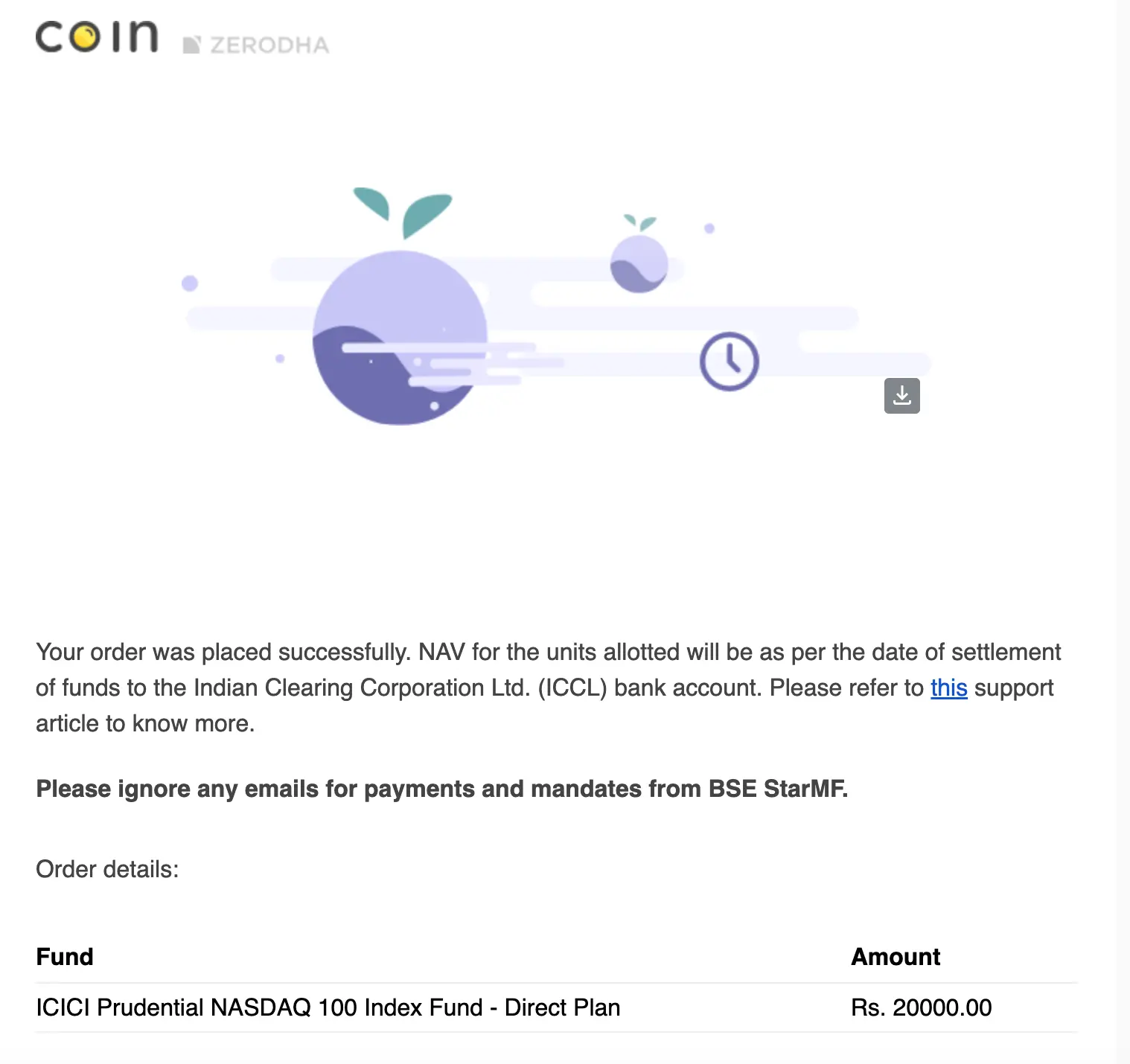

Once payments are made, you'll receive an email notification stating "Order was placed successfully."

Thank you for joining me on this exciting first step of our live trading journey. I hope today's session provided valuable insights into the process of building a robust investment portfolio from scratch. Stay tuned for more updates as we continue to navigate the markets and grow our investments together. Remember, every trade teaches us something new, and together, we're on the path to becoming savvier investors. Happy investing, and see you in the next session!

Join us live as we add Motilal Oswal Nasdaq 100 FOF to our portfolio this Monday, April 15, 2024. Discover insights and real-time updates on our investment journey!

Join live trading journey and explore the Bandhan Nifty 50 Index Fund with a low expense ratio of 0.1%. Discover a stable, high-performing investment option with no lock-in and zero exit load, and see how it can double your money every four years.

The best savings bank accounts in India. Ideal for the everyday saver, we highlight accounts with high interest rates, low fees, and convenient banking services. Make your money work harder for you with our top picks for hassle-free saving.